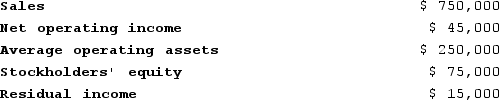

The following data are for the Akron Division of Consolidated Rubber, Incorporated:  For the past year, the margin used in return on investment calculations was:

For the past year, the margin used in return on investment calculations was:

Definitions:

Government's Revenue

The total income received by the government from various sources, including taxes, fees, fines, and the sale of goods and services.

Personal Income Taxes

Taxes levied on individuals or households based on the income they earn within a given year.

Subsidies

Financial support granted by the government or a public body to help an industry or business keep the prices of a commodity or service low.

Automobile Purchases

The action or activity of buying vehicles intended for personal or commercial use on roads.

Q8: Financial measures such as return on investment

Q28: Morr Logistic Solutions Corporation has developed a

Q68: Azotea Corporation has two operating divisions-a Consumer

Q73: Phann Corporation manufactures one product. It does

Q73: Rigoletto Company's quality cost report is to

Q96: Fluegge Incorporated has provided the following data

Q129: Beamer Corporation produces one product and it

Q139: Vandenheuvel Corporation keeps careful track of the

Q208: Mongar Corporation applies manufacturing overhead to products

Q335: Azotea Corporation has two operating divisions-a Consumer