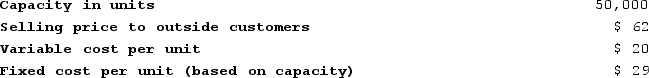

Ganus Products, Incorporated, has a Relay Division that manufactures and sells a number of products, including a standard relay that could be used by another division in the company, the Electronics Division, in one of its products. Data concerning that relay appear below:  The Electronics Division is currently purchasing 7,000 of these relays per year from an overseas supplier at a cost of $59 per relay.Assume that the Relay Division is selling all of the relays it can produce to outside customers. Does there exist a transfer price that would make both the Relay and Electronics Division financially better off than if the Electronics Division were to continue buying its relays from the outside supplier?

The Electronics Division is currently purchasing 7,000 of these relays per year from an overseas supplier at a cost of $59 per relay.Assume that the Relay Division is selling all of the relays it can produce to outside customers. Does there exist a transfer price that would make both the Relay and Electronics Division financially better off than if the Electronics Division were to continue buying its relays from the outside supplier?

Definitions:

Correlation

A statistical measure that indicates the extent to which two or more variables fluctuate together. A positive correlation indicates that variables move in the same direction, while a negative correlation indicates they move in opposite directions.

Risk-Free Rate

The hypothesized return on an investment that carries no risk, often linked with government bonds.

Minimum Required Return

The lowest acceptable return on an investment, considering the risk and the cost of capital.

Expected Return

The anticipated return on an investment, taking into account the probabilities of each potential outcome.

Q20: Mccreary Corporation manufactures one product. It does

Q34: Frame Corporation's Maintenance Department provides services to

Q46: Wolery Incorporated has provided the following data

Q47: Oaks Company maintains a cafeteria for its

Q99: Ritner Corporation manufactures a product that has

Q100: Brull Products, Incorporated, has a Sensor Division

Q212: At Eady Corporation, maintenance is a variable

Q227: Kneller Company manufactures and sells medals for

Q281: Solly Corporation produces a product for national

Q288: Chavin Company had the following results during