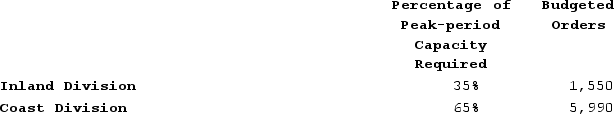

Sauseda Corporation has two operating divisions-an Inland Division and a Coast Division. The company's Customer Service Department provides services to both divisions. The variable costs of the Customer Service Department are budgeted at $30 per order. The Customer Service Department's fixed costs are budgeted at $474,000 for the year. The fixed costs of the Customer Service Department are determined based on the peak-period orders.

At the end of the year, actual Customer Service Department variable costs totaled $239,295 and fixed costs totaled $476,350. The Inland Division had a total of 1,585 orders and the Coast Division had a total of 5,940 orders for the year.

At the end of the year, actual Customer Service Department variable costs totaled $239,295 and fixed costs totaled $476,350. The Inland Division had a total of 1,585 orders and the Coast Division had a total of 5,940 orders for the year.

Required:a. Prepare a report showing how much of the Customer Service Department's costs should be charged to each of the operating divisions at the end of the year.b. How much of the actual Customer Service Department costs should not be charged to the operating divisions at the end of the year? Who should be held responsible for these uncharged costs?

Definitions:

Q102: Which of the following would be classified

Q112: A manufacturing cycle efficiency (MCE) ratio of

Q114: Fabrick Company's quality cost report is to

Q125: Robins Corporation manufactures one product. It does

Q161: Sobus Corporation manufactures one product. It does

Q179: Schabel Corporation has two operating divisions-a Consumer

Q314: Eagan Corporation manufactures one product. The company

Q371: Miguez Corporation makes a product with the

Q381: Solly Corporation produces a product for national

Q441: Irving Corporation makes a product with the