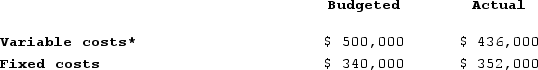

Leslie Company operates a cafeteria for the benefit of its employees. The company subsidizes the cafeteria heavily by allowing employees to purchase meals at greatly reduced prices. Budgeted and actual costs in the cafeteria for the year just ended are as follows:

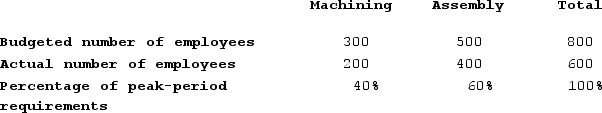

*Unrecovered cost after deducting amounts received from employees.Costs of the cafeteria are charged to producing departments on the basis of the number of employees in these departments. Fixed costs are charged on the basis of the percentage of peak-period requirements. Data concerning the company's producing departments follows:

*Unrecovered cost after deducting amounts received from employees.Costs of the cafeteria are charged to producing departments on the basis of the number of employees in these departments. Fixed costs are charged on the basis of the percentage of peak-period requirements. Data concerning the company's producing departments follows:

Required: a. Compute the dollar amount of variable and fixed costs that should be charged to each of the producing departments at the end of the year for purposes of evaluating performance.b. Identify the amount, if any, of actual costs that should not be charged to the operating departments.

Required: a. Compute the dollar amount of variable and fixed costs that should be charged to each of the producing departments at the end of the year for purposes of evaluating performance.b. Identify the amount, if any, of actual costs that should not be charged to the operating departments.

Definitions:

Lessor

The party in a lease agreement that owns the asset and grants the lessee the right to use the asset in return for lease payments.

Bargain Purchase Option

A lease clause allowing the lessee to purchase the leased asset at a price significantly lower than its expected fair market value at the end of the lease term.

Leased Asset's Useful Life

The expected period over which a leased asset is anticipated to be used by the lessee, often corresponding to the lease term unless a shorter period is more representative.

Minimum Lease Payments

The lowest amount that a lessee is expected to pay over the lease term, including both principal and interest components.

Q5: As part of a client's health history,

Q24: The West Division of Cecchetti Corporation had

Q47: Customer value propositions typically fall into three

Q220: Nanke Products, Incorporated, has a Sensor Division

Q311: Suppose a company evaluates divisional performance using

Q333: Ravena Labs., Incorporated makes a single product

Q337: The following labor standards have been established

Q349: Miguez Corporation makes a product with the

Q365: Dobrowolski Corporation manufactures one product. It does

Q437: Obenshain Corporation manufactures one product. The company