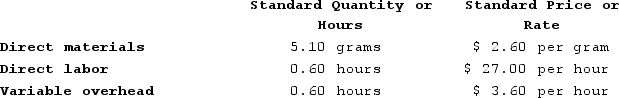

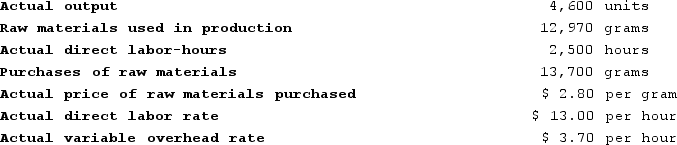

Bulluck Corporation makes a product with the following standard costs:  The company reported the following results concerning this product in July.

The company reported the following results concerning this product in July. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The variable overhead efficiency variance for July is:

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The variable overhead efficiency variance for July is:

Definitions:

Index Model

A statistical model used to predict the returns of assets based on the returns of a benchmark market index and the assets' sensitivities to that index.

Covariances

A measure of how two stocks move together, indicating the degree to which their returns are interdependent.

Security Pairs

A strategy in trading involving two closely related securities, where one is purchased (long position) and the other is sold (short position).

Index Model

A statistical model used to represent the returns of a financial market index, essentially simplifying securities analysis by correlating a particular stock or portfolio's performance to a broader market benchmark.

Q3: A nurse is preparing to draw blood

Q6: A medical-surgical nurse is caring for multiple

Q7: A physician orders an infusion of fresh

Q33: Runyon Incorporated reported the following results from

Q40: Bondi Corporation makes automotive engines. For the

Q47: Oaks Company maintains a cafeteria for its

Q130: Floria Corporation manufactures one product. It does

Q131: For performance evaluation purposes, the actual fixed

Q164: Puvo, Incorporated, manufactures a single product in

Q296: Jakeman Corporation manufactures one product. It does