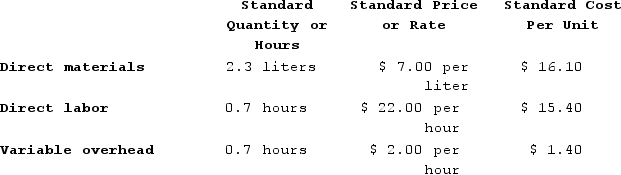

Miguez Corporation makes a product with the following standard costs:  The company budgeted for production of 2,600 units in September, but actual production was 2,500 units. The company used 5,440 liters of direct material and 1,680 direct labor-hours to produce this output. The company purchased 5,800 liters of the direct material at $7.20 per liter. The actual direct labor rate was $24.10 per hour and the actual variable overhead rate was $1.90 per hour.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The variable overhead rate variance for September is:

The company budgeted for production of 2,600 units in September, but actual production was 2,500 units. The company used 5,440 liters of direct material and 1,680 direct labor-hours to produce this output. The company purchased 5,800 liters of the direct material at $7.20 per liter. The actual direct labor rate was $24.10 per hour and the actual variable overhead rate was $1.90 per hour.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The variable overhead rate variance for September is:

Definitions:

New Stock

Shares that are issued to the public for the first time through an initial public offering or as additional shares by a company.

Component Cost

Component cost refers to the cost associated with each separate element or 'component' in the process of calculating a company's Weighted Average Cost of Capital (WACC).

Debt Issue

The act of a company raising money through the sale of bonds or other fixed-income securities.

Tax Rate

The percentage at which an individual or corporation is taxed. The tax rate may vary based on income level, type of income, or other factors.

Q54: Miguez Corporation makes a product with the

Q65: Mirabito Incorporated has provided the following data

Q135: Valera Corporation makes a product with the

Q148: Valera Corporation makes a product with the

Q164: Shular Products, Incorporated, has a Valve Division

Q165: Tron Products, Incorporated has a Pump Division

Q192: Cannata Corporation has two operating divisions--a North

Q221: Division A makes a part with the

Q313: Chavin Company had the following results during

Q360: Khat Incorporated makes a single product--a cooling