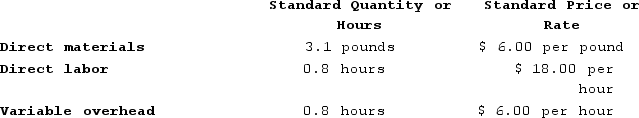

Galeazzi Corporation makes a product with the following standard costs:

In October the company produced 3,000 units using 8,380 pounds of the direct material and 2,610 direct labor-hours. During the month, the company purchased 9,500 pounds of the direct material at a total cost of $55,100. The actual direct labor cost for the month was $48,546 and the actual variable overhead cost was $16,965. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

In October the company produced 3,000 units using 8,380 pounds of the direct material and 2,610 direct labor-hours. During the month, the company purchased 9,500 pounds of the direct material at a total cost of $55,100. The actual direct labor cost for the month was $48,546 and the actual variable overhead cost was $16,965. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

Required:a. Compute the materials quantity variance.b. Compute the materials price variance.c. Compute the labor efficiency variance.d. Compute the labor rate variance.e. Compute the variable overhead efficiency variance.f. Compute the variable overhead rate variance.

Definitions:

Q12: A nurse has given instructions to a

Q16: A client who is to receive 4

Q75: Which of the following does not represent

Q81: Zhao incorporated her sole proprietorship by transferring

Q97: Which of the following statements best describes

Q129: Which of the following items is subject

Q163: Stallbaumer Incorporated makes a single product--an electrical

Q192: Cannata Corporation has two operating divisions--a North

Q216: Ganus Products, Incorporated, has a Relay Division

Q310: Moozi Dairy Products processes and sells two