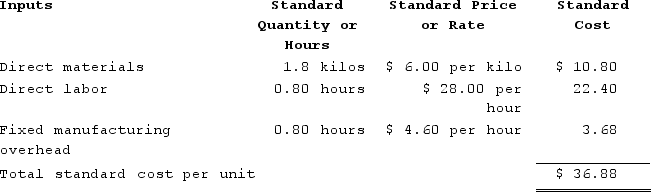

Pioli Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $92,000 and budgeted activity of 20,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $92,000 and budgeted activity of 20,000 hours.

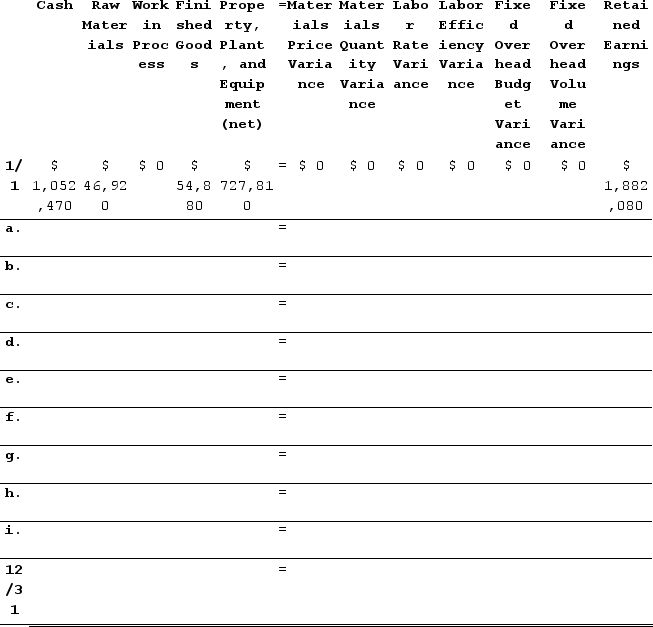

During the year, the company completed the following transactions:Purchased 34,300 kilos of raw material at a price of $5.40 per kilo.Used 35,000 kilos of the raw material to produce 19,500 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 14,900 hours at an average cost of $28.80 per hour.Applied fixed overhead to the 19,500 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $143,440. Of this total, $60,160 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $83,280 related to depreciation of manufacturing equipment.Transferred 19,500 units from work in process to finished goods.Sold for cash 20,100 units to customers at a price of $60.90 per unit.Completed and transferred the standard cost associated with the 20,100 units sold from finished goods to cost of goods sold.Paid $44,790 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.Required:1. Compute all direct materials, direct labor, and fixed overhead variances for the year.2. Record the above transactions in the worksheet that appears below. The beginning balances have been provided for each of the accounts, including the Property, Plant, and Equipment (net) account which is abbreviated as PP&E (net).

3. Determine the ending balance (e.g., 12/31 balance) in each account.4. Prepare an income statement for the year.

3. Determine the ending balance (e.g., 12/31 balance) in each account.4. Prepare an income statement for the year.

Definitions:

Reciprocity Agreement

An agreement between two parties to provide similar benefits or services to each other, often found in trade and partnership contexts.

List Price

The suggested retail price set by a manufacturer or retailer for a product, often not reflecting discounts or promotions.

Allowances

Financial or material provisions made to cover a specific need, expense, or reduction in price.

Rent

A periodic fee paid by a tenant to a landlord for the use of property, such as real estate or equipment.

Q32: KBL, Incorporated, AGW, Incorporated, Blaster, Incorporated, Shiny

Q114: If partnership debt is reduced and a

Q116: Peter, Matt, Priscilla, and Mary began the

Q134: Alvino Corporation manufactures one product. It does

Q196: Dirickson Incorporated has provided the following data

Q204: The general model for calculating a quantity

Q245: Woodhouse Corporation manufactures one product. It does

Q281: Solly Corporation produces a product for national

Q320: As defined it the text, the ending

Q395: Bohon Corporation manufactures one product. It does