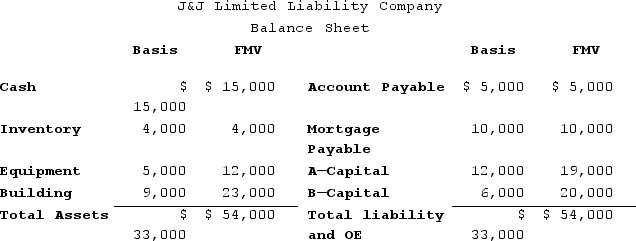

J&J, LLC, was in its third year of operations when J&J decided to expand the number of members from two, A and B, with equal profits and capital interests, to three members, A, B, and C. The third member, C, will contribute her financial expertise to the LLC in exchange for a one-third capital interest in J&J. Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J, when C receives her capital interest? If, instead, member C receives a one-third profits interest, what would be the tax consequences to members A, B, and C, and to J&J?

Definitions:

Wertheimer

A founding figure in the school of thought known as Gestalt psychology, emphasizing the whole of anything is greater than its parts.

Mechanically Repetitive Means

Processes or methods that involve repetition of the same physical movements or sequences with little variation, often used in manufacturing or routine tasks.

Rote Means

Learning by memorization without understanding the underlying logic.

Creativity

The ability to produce original and valuable ideas through imagination, ingenuity, and thinking outside the conventional boundaries.

Q13: A nurse is preparing to assist a

Q14: A nurse prepares to hang an infusion

Q38: Aztec Company reports current E&P of $200,000

Q85: Sue transferred 100 percent of her stock

Q93: Which of the following statements best describes

Q93: Viking Corporation is owned equally by Sven

Q97: Which of the following statements best describes

Q116: Milanese Corporation manufactures one product. It does

Q116: A taxpayer who receives nonvoting stock is

Q129: Which of the following items is subject