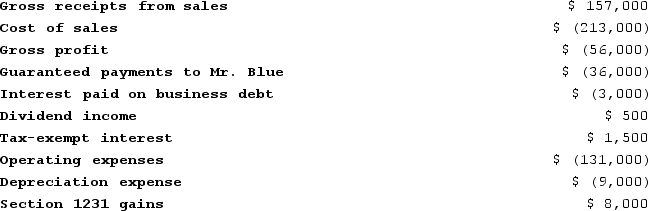

On January 1, 20X9, Mr. Blue and Mr. Grey each contributed $100,000 to form the B&G General Partnership. Their partnership agreement states that they will each receive a 50 percent profits and loss interest. The partnership agreement also provides that Mr. Blue will receive an annual $36,000 guaranteed payment. B&G began business on January 1, 20X9. For its first taxable year, its accounting records contained the following information:

The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30, 20X9. B&G repaid $10,000 of the loan on December 15, 20X9. Neither of the partners received a cash distribution from B&G in 20X9.

The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30, 20X9. B&G repaid $10,000 of the loan on December 15, 20X9. Neither of the partners received a cash distribution from B&G in 20X9.

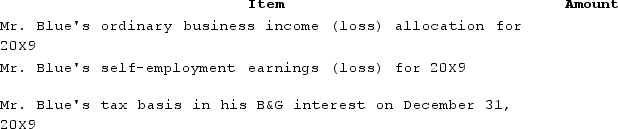

Complete the following table related to Mr. Blue's interest in B&G partnership:

Definitions:

Tuberculosis (TB)

A potentially serious infectious disease caused by the bacterium Mycobacterium tuberculosis, affecting mainly the lungs but can spread to other organs.

Ampule

A sealed glass container used to hold and preserve a sample, usually a liquid or solid, in a sterile environment.

Filter Needle

A needle equipped with a filter used to remove particulate matter from a solution before administration.

Intradermal Injection

A method of administering medication by injecting it into the dermis, the layer of skin directly beneath the epidermis.

Q1: A nurse suspects that a client with

Q2: Frank and Bob are equal members in

Q11: A nurse attends a class on the

Q12: A nurse obtains a blood specimen for

Q42: Viking Corporation is owned equally by Sven

Q49: Purple Rose Corporation reported pretax book income

Q56: Which of the following statements is false

Q81: At the end of Year 1, Tony

Q121: NOL and capital loss carryovers are deductible

Q264: Catherman Corporation manufactures one product. It does