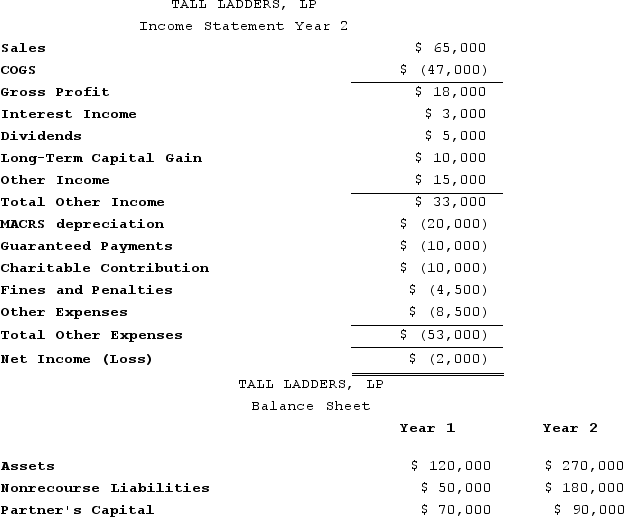

At the end of Year 1, Tony had a tax basis of $40,000 in Tall Ladders, Limited Partnership. Tony has a 20 percent profits interest in Tall Ladders. For Year 2, Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership. Given the following income statement and balance sheet from Tall Ladders, what is Tony's adjusted tax basis at the end of Year 2?

Definitions:

Government Intervention

The involvement or actions by a government in a market, often intended to correct inefficiencies and failures.

Asymmetric Information

Asymmetric information exists when one party in a transaction has more or superior information compared to another, leading to an imbalance in power and potentially unfair outcomes.

Wage Changes

Adjustments in the rate of pay received by workers, which can be influenced by factors such as inflation, market demands, and changes in productivity.

Monitoring

The process of systematically checking or tracking the performance or quality of a process, system, or entity over time for oversight and evaluation purposes.

Q4: A nurse is preparing to administer I.V.

Q14: Lynch Company had a net deferred tax

Q16: A client who is to receive 4

Q23: A client presents to an emergency department

Q56: Acai Corporation determined that $5,000,000 of its

Q77: Kedzie Company determined that the book basis

Q87: TarHeel Corporation reported pretax book income of

Q114: Grand River Corporation reported taxable income of

Q123: Tom is talking to his friend Bob,

Q448: Robins Corporation manufactures one product. It does