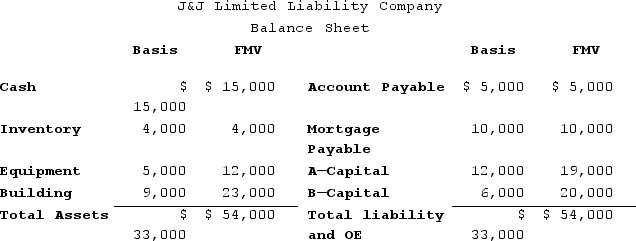

J&J, LLC, was in its third year of operations when J&J decided to expand the number of members from two, A and B, with equal profits and capital interests, to three members, A, B, and C. The third member, C, will contribute her financial expertise to the LLC in exchange for a one-third capital interest in J&J. Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J, when C receives her capital interest? If, instead, member C receives a one-third profits interest, what would be the tax consequences to members A, B, and C, and to J&J?

Definitions:

HR Personnel

Individuals working within the human resources department, responsible for managing recruitment, employee relations, and organizational development.

Final Interview

The last step in the interview process where a candidate meets with key decision-makers before a hiring decision is made.

Behavior Description

A method used in interviews asking candidates to describe past behavior as evidence of their ability to perform in a specific situation.

Emotionally Unstable

Refers to individuals who experience rapid, intense emotional changes that are difficult to manage and can affect their behavior and relationships.

Q5: A nurse is caring for an elderly,

Q10: Diego owns 30 percent of Azul Corporation.

Q11: A client is to receive peripheral parenteral

Q19: Costello Corporation reported pretax book income of

Q46: Lynch Company had a net deferred tax

Q89: Orange Incorporated issued 20,000 nonqualified stock options

Q106: General Inertia Corporation made a distribution of

Q223: Isenberg Corporation manufactures one product. It does

Q282: Kita Corporation manufactures one product. It does

Q350: Freiling Corporation manufactures one product. It does