Alfred, a one-third profits and capital partner in Pizzeria Partnership, needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for Year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of Year 2 of the partnership was $23,000. Thankfully, Alfred still has his Schedule K-1 from the partnership for Years 1 and 2.

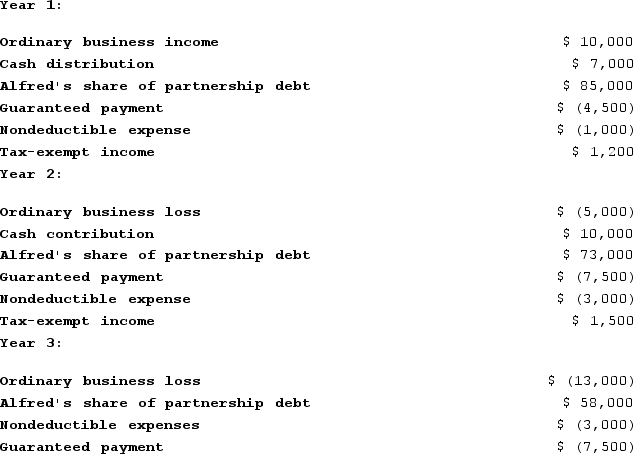

Using the following information from Alfred's Year 1, Year 2, and Year 3 Schedule K-1, calculate his tax basis the end of Year 2 and Year 3.

Definitions:

Income Statement

A financial statement that shows a company's revenue and expenses over a specific period, culminating in its net income or loss.

Debt-To-Equity Ratio

An economic indicator reflecting the comparative levels of debt and shareholders' equity utilized in financing a company's assets.

Financial Statements

Formal records of the financial activities and position of a business, person, or other entity, typically comprising the balance sheet, income statement, and cash flow statement.

Debt-To-Equity Ratio

A measure revealing the ratio of debt to shareholders' equity in the financing structure of a company's assets.

Q1: A quality-control nurse reviews procedures to decrease

Q6: Coop Incorporated owns 40percent of Chicken Incorporated.

Q10: A nurse is to draw a blood

Q15: The City of Boston made a capital

Q23: Remsco has taxable income of $69,000 and

Q25: Beaver Company reports current E&P of $100,000

Q51: This year the shareholders in Lucky Corporation

Q80: TarHeel Corporation reported pretax book income of

Q81: At the end of Year 1, Tony

Q294: Bohon Corporation manufactures one product. It does