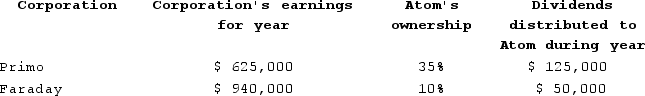

Atom Ventures Incorporated (AV) owns stock in the Primo and Faraday corporations. The following summarizes information relating to AV's investment in Primo and Faraday as follows:

Assuming that AV follows the general rules for reporting its income from these investments and the value of AV's stock investments in Primo and Faraday is equal to AV's basis in these investments, what is the amount of AV's book-tax difference associated with the investment in these corporations (disregarding the dividends received deduction)? Is it favorable or unfavorable? Is it permanent or temporary?

Assuming that AV follows the general rules for reporting its income from these investments and the value of AV's stock investments in Primo and Faraday is equal to AV's basis in these investments, what is the amount of AV's book-tax difference associated with the investment in these corporations (disregarding the dividends received deduction)? Is it favorable or unfavorable? Is it permanent or temporary?

Definitions:

Ineffective

Something that fails to produce the desired result or outcome.

Shared Mission

A collective goal or purpose that unites members of a group or organization in their efforts.

Responsibility

The state or fact of having a duty to deal with something or of having control over someone.

Complex Challenges

Problems or situations that are multifaceted and difficult to solve, requiring innovative and comprehensive approaches.

Q13: Which of the following items is not

Q22: Gain and loss realized in a §351

Q27: Shelley is self-employed in Texas and recently

Q27: Jamie transferred 100 percent of her stock

Q37: Taxpayers must maintain written contemporaneous records of

Q63: Otto operates a bakery and is on

Q73: General partnerships are legally formed by filing

Q118: Taffy Products uses the accrual method and

Q119: The term "E&P" iswell defined in the

Q132: Which one of the following is not