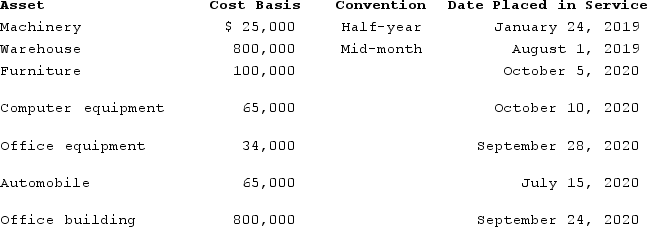

BoxerLLC has acquired various types of assets recently used 100 percent in its trade or business. Below is a list of assets acquired during 2019 and 2020:

Boxer did not elect §179 expense and elected out of bonus depreciation in 2019, but would like to take advantage of the §179 expense and bonus depreciation for 2020 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation deduction for 2020. (Use MACRS Table 1, MACRS Table 5, and Exhibit 10-10.) (Round final answer to the nearest whole number.)

Boxer did not elect §179 expense and elected out of bonus depreciation in 2019, but would like to take advantage of the §179 expense and bonus depreciation for 2020 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation deduction for 2020. (Use MACRS Table 1, MACRS Table 5, and Exhibit 10-10.) (Round final answer to the nearest whole number.)

Definitions:

Misstatement

An incorrect statement or representation, often referring to inaccuracies in financial statements or reports.

Materiality

Refers to the importance or significance of information, actions, or facts in influencing decisions within a business, legal, or financial context.

Section 11

A provision of the Securities Act of 1933 that holds issuers liable for any material misstatements or omissions in their registration statements.

Securities Act of 1933

A U.S. federal law that regulates the sale of securities to the public, requiring transparency and disclosure to protect investors.

Q1: Ypsi Corporation has a precredit U.S. tax

Q10: Limited partnerships are legally formed by filing

Q11: Jasmine started a new business in the

Q18: Delivery of tangible personal property through common

Q22: For the holidays, Samuel gave a necklace

Q31: Under the book value method of allocating

Q49: Andrew and Brianna are married and live

Q56: Acai Corporation determined that $5,000,000 of its

Q67: Remsco has taxable income of $60,000 and

Q92: Business assets that tend to be used