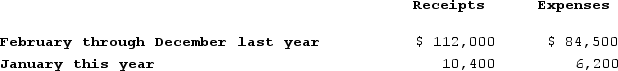

David purchased a deli shop on February 1st of last year and began to operate it as a sole proprietorship. David reports his personal taxes using the cash method over a calendar year, and he wants to use the cash method and fiscal year for his sole proprietorship. He has summarized his receipts and expenses through January 31st of this year as follows:

What income should David report from his sole proprietorship?

What income should David report from his sole proprietorship?

Definitions:

Interpersonal Problems

Issues arising from interactions between individuals that can lead to conflicts or disagreements.

Juvenile Killings

Homicidal acts committed by individuals who are legally considered minors.

U.S. Schools

Educational institutions in the United States that provide formal instruction and education to students in various grades, from kindergarten through 12th grade and beyond.

Self-Precipitated

Situations or outcomes that are brought about by an individual's own actions or behaviors, often implying a degree of responsibility.

Q2: Sophia is single and owns the following

Q34: A U.S. corporation can use hybrid entities

Q35: For which type of entity does the

Q51: Misha traded computer equipment used in her

Q74: PC Mine purchased a platinum deposit for

Q81: Andrea transferred $677,500 of stock to a

Q116: Reid had a business building destroyed in

Q122: Which of the following is NOT considered

Q126: BoxerLLC has acquired various types of assets

Q135: The tax on cumulative taxable gifts is