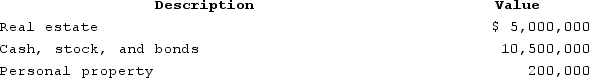

At his death in 2020, Nathan owned the following property:

The real estate is subject to a $1,700,000 mortgage and Nathan made taxable gifts in 2009 totaling $2 million, at which time he offset the gift tax with an applicable credit (exemption equivalent of $2 million). Nathan has never been married. What is the amount of his estate tax due? (Use Exhibit 14-1.)

The real estate is subject to a $1,700,000 mortgage and Nathan made taxable gifts in 2009 totaling $2 million, at which time he offset the gift tax with an applicable credit (exemption equivalent of $2 million). Nathan has never been married. What is the amount of his estate tax due? (Use Exhibit 14-1.)

Definitions:

Critical Value

A threshold in statistics above or below which a statistical result is considered significant.

Dogs

Domesticated mammals known for their loyalty and companionship, classified in the species Canis lupus familiaris.

Hypotheses

Hypotheses are proposed explanations made on the basis of limited evidence as starting points for further investigation.

Standard Error

The standard deviation of the sampling distribution of a statistic, most commonly of the mean.

Q8: Cost depletion is available to all natural

Q10: Gordon operates the Tennis Pro Shop in

Q12: Sandy Bottoms Corporation generated taxable income (before

Q17: The generation-skipping tax is designed to accomplish

Q36: Handsome Rob provides transportation services in several

Q39: Which of the following does not ultimately

Q77: Alexis transferred $400,000 to a trust with

Q80: Kathy is a 25percent partner in the

Q95: Which of the following expenses incurred by

Q135: When an S corporation distributes appreciated property