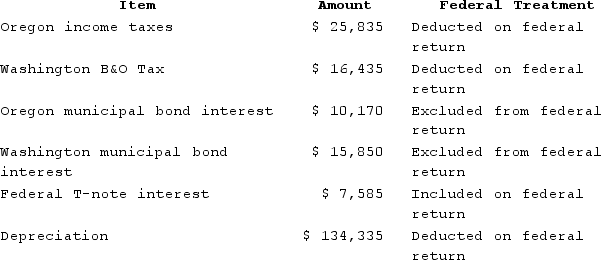

Moss Incorporated is a Washington corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:

Moss's Oregon depreciation was $145,585. Moss's federal taxable income was $549,913. Assuming Oregon taxes all municipal bond interest, calculate Moss's Oregon state tax base.

Moss's Oregon depreciation was $145,585. Moss's federal taxable income was $549,913. Assuming Oregon taxes all municipal bond interest, calculate Moss's Oregon state tax base.

Definitions:

Job Applicants

Individuals who apply for a specific position within an organization, submitting their qualifications for consideration by potential employers.

Job Analysis

The process of studying and collecting information about the content, context, and requirements of a job.

Skill Requirements

The specific competencies and abilities necessary for performing a job or task successfully.

Staffing Strategy

An approach or plan for securing, developing, and retaining a workforce that is capable of fulfilling an organization's objectives and needs.

Q18: Which of the following expenditures is NOT

Q28: Porter's "national diamond" framework suggests that a

Q39: Public Law 86-272 protects a taxpayer from

Q86: Beth operates a plumbing firm. In August

Q91: Which of the following statements regarding a

Q110: The SSC, a cash-method partnership, has a

Q114: Distributions to owners may not cause the

Q114: What was the Supreme Court's holding in

Q145: Jayden gave Olivia a ring when she

Q156: At the beginning of the year, Clampett,