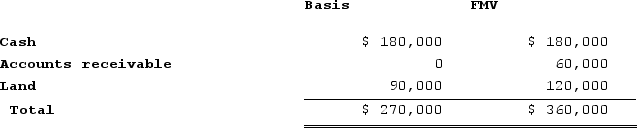

The SSC, a cash-method partnership, has a balance sheetthat includes the following assets on December 31 of the current year:  Susan, a one-third partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $120,000 cash, how much capital gain and ordinary income must Susan recognize from the sale?

Susan, a one-third partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $120,000 cash, how much capital gain and ordinary income must Susan recognize from the sale?

Definitions:

Centralized Inventory

A management approach where all stock is kept in a single location, facilitating easier inventory control and management.

Decentralized Inventory

An inventory management strategy where stock is kept in multiple locations to reduce delivery times and increase service levels.

Facility Layout

The arrangement of physical elements in a factory or workspace to optimize operations, including machinery, equipment, and staff.

Space Versus Equipment

The trade-off or balance between the physical area available for operations and the machinery or equipment required to produce goods or services.

Q2: Interest and dividends are allocated to the

Q9: McDonald's introduction of a greater number of

Q24: Lamont is a 100percent owner of JKL

Q33: The main strategy implication of the Boston

Q35: Organizations are like people: their essential characteristics-including

Q47: Achieving productivity gains from process innovation usually

Q54: Ryan placed $350,000 in trust with income

Q62: The throwback rule requires a company, for

Q101: Big Company and Little Company are both

Q140: Eric has $5.8 million of property that