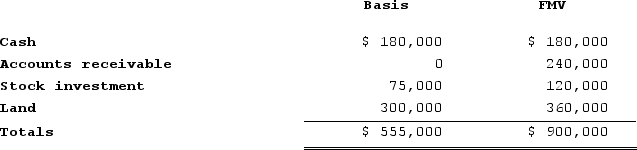

Katrina is a one-third partner in the KYR Partnership (calendar year-end). Katrina decides she wants to exit the partnership and receives a proportionate distribution to liquidate her partnership interest on January 1. The partnership has no liabilities and holds the following assets as of January 1:

Katrina receives one-third of each of the partnership assets. She has a basis in her partnership interest of $110,000. What is the amount and character of any recognized gain or loss to Katrina? What is Katrina's basis in the distributed assets?

Katrina receives one-third of each of the partnership assets. She has a basis in her partnership interest of $110,000. What is the amount and character of any recognized gain or loss to Katrina? What is Katrina's basis in the distributed assets?

Definitions:

Repairs

The process of fixing or restoring something that is damaged, broken, or worn out to bring it back to its original condition.

Possessory Lien

A legal right or interest that a lender or storage facility has in the item in possession, as security for payment of a debt or charge.

Rug Repairer

A professional specialized in fixing and restoring rugs to their original condition.

Innkeeper's Lien

A legal right allowing innkeepers to hold, or even sell, a guest's property as security for unpaid lodging bills.

Q1: Moss Incorporated is a Washington corporation. It

Q11: The primary mechanisms through which companies translate

Q16: The economic organization of the home improvement

Q19: PWD Incorporated is an Illinois corporation. It

Q28: When a winery opens a tasting room

Q38: Harold Geneen's statement that: "Telephones, hotels, insurance-it's

Q39: The success of the multidivisional structure as

Q78: Polka Corporation is a 100 percent owned

Q87: All income earned by a Swiss corporation

Q91: Bobby T (95percent owner) would like to