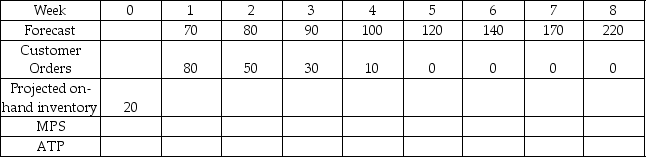

Table 11.2

Mutts Amazing Dogs has developed the following demand forecast for The Pitbull, a spicy concoction graced by pepperjack cheese, serrano, habanero, poblano and jalapeno peppers, onion, and a cilantro-lime aioli. They enter the planning period with 20 hotdogs in inventory as shown in Week 0. A few customers have standing orders for hotdogs and they have booked catering events over the next two months. They buy their hotdogs in packages of ten just like you and me.

-Use Table 11.2 to answer this question. Mutt decides to operate on a level MPS plan for weeks 1 through 4. What MPS quantity brings them into week 5 with the same ATP as if they had adopted a more traditional approach?

Definitions:

Federal Income Taxes Payable

The amount of income tax a company or individual owes to the federal government, which is due within the tax filing period.

Current Liabilities

Short-term financial obligations that are due within one year or within the normal operating cycle of a business, whichever is longer.

Unearned Revenues

Income received by a company for goods or services that have yet to be provided, recorded as a liability on the balance sheet.

Prepaid Expenses

Costs that are paid in advance for goods or services, which are recognized as expenses over time as the benefits are received.

Q7: _, the annual sales at cost divided

Q13: Steve-O engaged in _ by using only

Q18: Excel Products is planning a new warehouse

Q27: Common examples of sin taxes include the

Q40: What are the key inputs to an

Q48: Which one of the following statements correctly

Q53: _ is an inventory measure obtained by

Q54: Refer to Scenario 9.1. With the change

Q114: The Delphi method is a process of

Q160: Use the information in Scenario 9.4. What