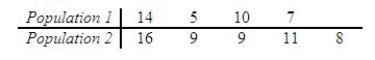

Two independent random samples of sizes  = 4 and

= 4 and  = 5 are selected from each of two normal populations:

= 5 are selected from each of two normal populations:  Calculate

Calculate  , the pooled estimator of

, the pooled estimator of  .

.

______________

Find a 90% confidence interval for (  ), the difference between the two population means.

), the difference between the two population means.

CI = ______________ Enter (n1, n2)

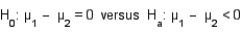

Test  for

for  = 0.05.

= 0.05.

Conclusion:

We ______________ have sufficient evidence to indicate  .

.

Definitions:

Bond-Yield-Plus-Risk-Premium

A method of estimating the cost of equity by adding a risk premium to the observed yield of a company’s long-term debt.

WACC

An assessment of a firm's cost of capital, where each category of capital is proportionally weighted to calculate the average cost.

Marginal Costs

Marginal costs refer to the change in total cost that arises when the quantity produced is incremented by one unit.

Target Capital Structure

Target capital structure is the proportional combination of debt, equity, and other financing sources a company aims to maintain.

Q6: A random sample of size 20 taken

Q22: When testing <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8220/.jpg" alt="When testing

Q28: In a two-way factor ANOVA, the total

Q30: In a simple linear regression analysis, if

Q30: A statistics professor wanted to test whether

Q38: In comparing two means when samples are

Q55: The degrees of freedom for a denominator

Q60: A cable company in Michigan is thinking

Q106: In testing the difference between two population

Q138: In a study of the relationship between