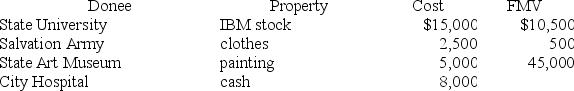

This year Darcy made the following charitable contributions:

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museum consistent with museum's charitable purpose.

Definitions:

Writing Requirement

A legal principle that certain kinds of contracts must be in writing to be enforceable.

Statute of Frauds

A legal principle that requires certain types of contracts to be written and signed by the parties involved to be enforceable.

Debt of Another

Debt of another involves liabilities or obligations that one party assumes on behalf of another party, typically through a guarantee or cosigning arrangement.

Uniform Electronic Transactions Act

A law adopted by many states in the U.S., which gives legal validity to electronic signatures and records in commercial transactions.

Q8: For the following taxpayers, please recommend the

Q28: Mike received the following interest payments this

Q39: This year, Fred and Wilma, married filing

Q41: Which of the following is not True

Q52: Which of the following statements regarding the

Q62: Char and Russ Dasrup have one daughter,

Q73: Desai and Lucy divorced in 2018. Lucy

Q78: Happy, Sleepy, Grumpy, and Doc all did

Q90: Mason and his wife Madison have been

Q110: During all of 2018, Mr. and Mrs.