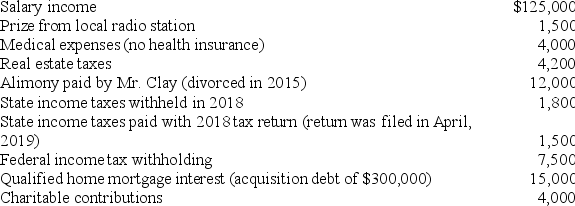

During all of 2018, Mr. and Mrs. Clay lived with their four children (all are under the age of 17). They provided over one-half of the support for each child. Mr. and Mrs. Clay file jointly for 2018. Neither is blind, and both are under age 65. They reported the following tax-related information for the year: (Use the tax rate schedules)

A. What is the Clays' taxes payable or (refund due) (ignore the alternative minimum tax)?

B. What is the Clays' tentative minimum tax and alternative minimum tax?

Definitions:

Absorption Costing

A cost accounting method that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed overhead - in the cost of a product.

Unit Product Cost

The total cost (both variable and fixed costs) associated with producing a single unit of a product.

Variable Costing

A method of inventory costing that includes only variable production costs—direct materials, direct labor, and variable manufacturing overhead—in product costs, excluding fixed manufacturing overhead.

Per Unit

A term that refers to expressing costs, revenues, or any other financial metric on a per unit of production or per unit of sale basis.

Q2: Which of the following gains does not

Q18: On December 1, 20X7, George Jimenez needed

Q24: Which of the following is True regarding

Q40: Kimberly's employer provides her with a personal

Q47: This fall Angelina, age 35, plans to

Q58: Heidi retired from GE (her employer) at

Q98: An office building was purchased on December

Q100: Deb has found it very difficult to

Q102: Tax cost recovery methods do not include:<br>A)

Q112: In 2018, John (52 years old) files