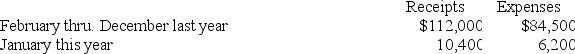

David purchased a deli shop on February 1ˢᵗ of last year and began to operate it as a sole proprietorship. David reports his personal taxes using the cash method over a calendar year, and he wants to use the cash method and fiscal year for his sole proprietorship. He has summarized his receipts and expenses through January 31ˢᵗ of this year as follows:

What income should David report from his sole proprietorship?

Definitions:

Irrational Process

Mental activities beyond logical reasoning, often influenced by emotions or subconscious thoughts.

Activating Event

In cognitive-behavioral therapy, an external situation or internal mental event that triggers a chain of thoughts, emotions, and behaviors.

Cognitive Dissonance

The state of having inconsistent thoughts, beliefs, or attitudes, especially as relating to behavioral decisions and attitude change.

Eustress

A positive form of stress that is perceived as beneficial, motivating, or enhancing to one's functioning.

Q3: Qualified employee discounts allow employees to purchase

Q40: Todd operates a business using the cash

Q40: Jackson earned a salary of $254,000 in

Q40: Jenna (age 50) files single and reports

Q59: The investment interest expense deduction is limited

Q76: Joe operates a plumbing business that uses

Q85: In 2018, Madison is a single taxpayer

Q87: This year Ed celebrated his 25ᵗʰ year

Q88: Ralph borrowed $4 million and used the

Q105: When determining the number of days a