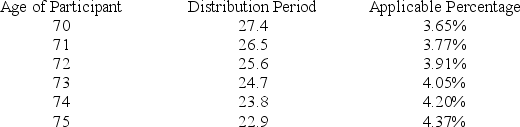

Sean (age 74 at end of 2018) retired five years ago. The balance in his 401(k) account on December 31, 2017 was $1,700,000 and the balance in his account on December 31, 2018 was $1,750,000. In 2018, Sean received a distribution of $50,000 from his 401(k) account. Assuming Sean's marginal tax rate is 25 percent, what amount of the $50,000 distribution will Sean have left after paying income tax on the distribution and paying any minimum distribution penalties (use the IRS table below in determining the minimum distribution penalty, if any).

Definitions:

Linear Effects

Phenomena or changes that are directly proportional to the changes in an independent variable, showing a straight-line relationship in graphical representations.

Worst Predictor

A variable or factor that provides little to no useful information in forecasting or predicting outcomes.

Linear Effects

The impact on a dependent variable that is proportional to the change in an independent variable, suggesting a straight-line relationship in a statistical model.

Months Of Service

The total number of months an individual has worked or served in a particular job or capacity.

Q4: Which of the following transactions results solely

Q16: Which of the following regarding the Form

Q26: Jones operates an upscale restaurant and he

Q31: Sole proprietors are subject to self-employment taxes

Q42: Anne LLC purchased computer equipment (5-year property)

Q43: Which of the following business expense deductions

Q66: Used property is eligible for bonus depreciation.

Q81: Tasha receives reimbursement from her employer for

Q83: Boxer LLC has acquired various types of

Q95: Jorge purchased a copyright for use in