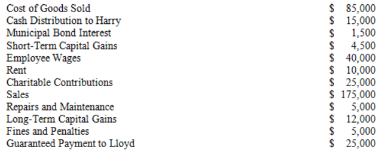

Lloyd and Harry, equal partners, form the Ant World Partnership. During the year, Ant World had the following revenue, expenses, gains, losses, and distributions:

Given these items, what amount of ordinary business income (loss) and what separately-stated items should be allocated to each partner for the year?

Definitions:

Coughing Vigorously

Forceful exhalation through the airways aimed at clearing them of irritants, mucus, or foreign particles.

Abdominal Thrusts

An emergency procedure to expel foreign objects from the airway of a choking victim, also known as the Heimlich maneuver.

Shoulder Blades

The flat, triangular bones located on the back of the shoulders, known anatomically as scapulae.

Child Wading Pool

A shallow pool designed for young children to play in under supervision, often portable and made of plastic.

Q11: Crescent Corporation is owned equally by George

Q16: A partnership may use the cash method

Q18: Property is included in the gross estate

Q44: Bruin Company received a $100,000 insurance payment

Q51: In 2018, Moody Corporation recorded the following

Q73: Taxable income of the all C corporations

Q77: Remsco has taxable income of $60,000 and

Q77: Actual or deemed cash distributions in excess

Q98: Husker Corporation reports current E&P of negative

Q98: XYZ was formed as a calendar-year S