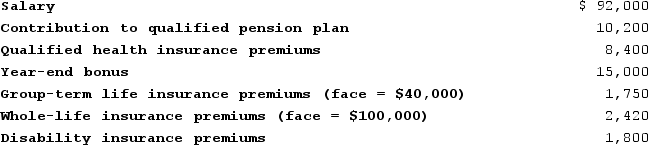

Andres has received the following benefits this year.

Besides these benefits Andres missed work for two months due to an illness. During his illness Andres received $6,500 in sick pay from a disability insurance policy. Assume Andres has disability insurance provided by his employer as a nontaxable fringe benefit. What amount, if any, must Andres include in gross income this year?

Besides these benefits Andres missed work for two months due to an illness. During his illness Andres received $6,500 in sick pay from a disability insurance policy. Assume Andres has disability insurance provided by his employer as a nontaxable fringe benefit. What amount, if any, must Andres include in gross income this year?

Definitions:

Therapeutic Abandonment

The inappropriate ending of treatment by a healthcare professional without arranging for the continued care of the patient.

Disaster Circumstances

Conditions caused by natural or human-made disasters that significantly affect communities, environments, and economies.

Local Counselor

A professional advisor or therapist who provides counseling services within a specific geographic area.

Referral

The process of directing someone to another professional or agency for additional services or expertise.

Q5: A 1 percent charge imposed by a

Q6: Wilma has a $45,000 certificate of deposit

Q15: Which of the following statements accurately describes

Q17: During 2020, Jasmine (age 12)received $7,350 from

Q18: Scholarships are excluded from gross income for

Q64: Hestia (age 17)is claimed as a dependent

Q72: All of the following are tests for

Q115: Jane and Ed Rochester are married with

Q119: The timing strategy becomes more attractive if

Q153: Depending on the year, the original (unextended)due