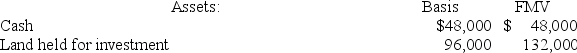

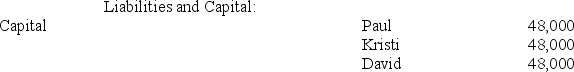

Kathy purchases a one-third interest in the KDP Partnership from Paul for $60,000. Just prior to the sale, Paul's outside and inside bases in KDP are $48,000. KDP's balance sheet includes the following:

If KDP has a §754 election in place, what is Kathy's special basis adjustment?

Definitions:

Production Possibility Frontier

A curve depicting the limit of attainable outputs for two or more products given a fixed set of resources, showing the trade-offs in production choices.

Output

The total amount of goods or services produced by a company, sector, or economy in a given period.

Slope

In mathematics, a measure of the steepness, incline, or grade of a line, typically calculated as the ratio of rise over run.

Purchased Abroad

Items or services bought from another country, often involving importation and subject to international trade policies and currency exchange rates.

Q11: Business income is allocated to the state

Q22: Tyson, a one-quarter partner in the TF

Q28: Lloyd and Harry, equal partners, form the

Q32: Jay has a tax basis of $14,000

Q40: Which of these items is not an

Q43: The applicable credit is designed to allow

Q52: Ashley owns a whole-life insurance policy worth

Q57: Amy is a U.S. citizen. During the

Q73: A general partner's share of ordinary business

Q114: An S corporation shareholder's allocable share of