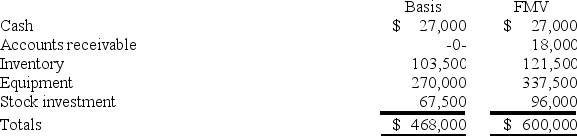

Victor is a 1/3 partner in the VRX partnership with an outside basis of $156,000 on January 1. Victor sells his partnership interest to Raj on January 1ˢᵗ for $200,000 cash. The VRX Partnership has the following assets and no liabilities as of January 1:

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased 7 years ago. What is the amount and character of Victor's gain or loss on the sale of his partnership interest?

Definitions:

Intermittent Reinforcement

Intermittent reinforcement rewards behavior only periodically.

Pavlov's Classical Conditioning

A learning process that occurs through associations between an environmental stimulus and a naturally occurring stimulus.

Stimulus

A stimulus is any event or situation that evokes a response or reaction from someone or something.

Vicarious Learning

A learning process where individuals acquire knowledge or behaviors by observing the actions and consequences experienced by others.

Q18: RGD Corporation was a C corporation from

Q19: Which of the following is not a

Q24: Why are guaranteed payments deducted in calculating

Q25: When determining a partner's gain on sale

Q53: Purchases of inventory for resale are typically

Q56: All of the following are False regarding

Q67: Under the book value method of allocating

Q85: Erica and Brett decide to form their

Q99: Which of the following statements is not

Q100: Kathy is a 25% partner in the