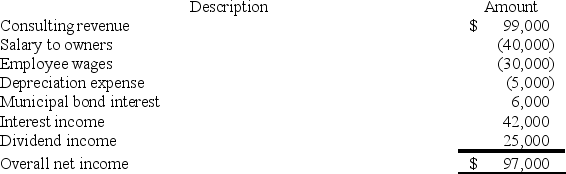

RGD Corporation was a C corporation from its inception in 2013 through 2017. However, it elected S corporation status effective January 1, 2018. RGD had $50,000 of earnings and profits at the end of 2017. RGD reported the following information for its 2018 tax year.

What amount of excess net passive income tax is RGD liable for in 2018? Assume the corporate tax rate is 21%. (Round your answer for excess net passive income to the nearest thousand).

Definitions:

Global Warming

Increasing global atmospheric and oceanic temperatures as measured or inferred from some point in the past to the present.

Lithosphere

The rigid outer layer of the earth, including the crust and upper mantle, which is divided into tectonic plates.

Biosphere

The global sum of all ecosystems, including all living organisms and their relationships to each other and to their environments.

Groundwater

Water that occurs in the pores, fractures, and cavities in the subsurface.

Q11: Andrew and Brianna are married and live

Q18: Which statement best describes the U.S. framework

Q35: If a buyer is evaluating a sales

Q36: The gift-splitting election only applies to gifts

Q37: Boston, Inc. made a capital contribution of

Q50: U.S. corporations are eligible for a foreign

Q66: The VRX Partnership (a calendar year-end entity)

Q82: Lola is a 35% partner in the

Q84: Partners adjust their outside basis by adding

Q98: Which of the items is correct regarding