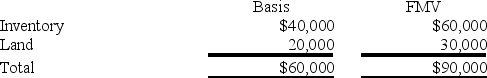

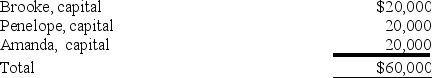

BPA Partnership is an equal partnership in which each of the partners has a basis in her partnership interest of $20,000. BPA reports the following balance sheet:

a. Identify the hot assets if Brooke decides to sell her interest in BPA.

b. Are these assets "hot" for purposes of distributions?

c. If BPA distributes the land to Brooke in complete liquidation of her partnership interest, what tax issues should be considered?

Definitions:

Q12: An additional allocation of partnership debt or

Q15: The SSC Partnership balance sheet includes the

Q30: Catherine is a 30% partner in the

Q30: Which of the following statements regarding partnerships

Q30: Nexus involves the criteria used by a

Q32: Differences in voting powers are permissible across

Q60: As salespeople serve their customers,they simultaneously serve

Q98: Adjusted taxable gifts are added to the

Q100: A stock-for-stock Type B reorganization will be

Q117: S corporations have considerable flexibility in making