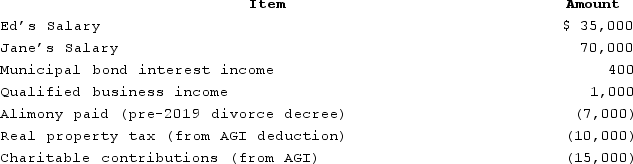

Jane and Ed Rochester are married with a 2-year-old child, who lives with them and whom they support financially. In 2020, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2020 standard deduction amount for MFJ taxpayers is $24,800. What is the couple's taxable income?

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2020 standard deduction amount for MFJ taxpayers is $24,800. What is the couple's taxable income?

Definitions:

Known Distribution

A statistical term referring to a distribution whose properties (such as mean and variance) are known.

Correlation

An indicator that measures the level at which several variables co-vary.

Personality Traits

Enduring characteristics that describe an individual's behavior, emotions, and thoughts.

Questionnaire

A survey consisting of a series of questions aimed at gathering information about individuals' preferences, thoughts, attitudes, or behaviors.

Q10: During all of 2020, Mr. and Mrs.

Q29: Capital loss carryovers for individuals are carried

Q29: Which of the following is not considered

Q30: Which of the following is a true

Q43: What is the correct order of the

Q49: The timing strategy becomes more attractive as

Q53: Losses associated with personal-use assets, sales to

Q56: Kaylee is a self-employed investment counselor who

Q91: All of the following are for AGI

Q93: The main difficulty in calculating an income