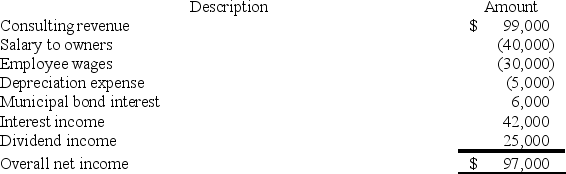

RGD Corporation was a C corporation from its inception in 2013 through 2017. However, it elected S corporation status effective January 1, 2018. RGD had $50,000 of earnings and profits at the end of 2017. RGD reported the following information for its 2018 tax year.

What amount of excess net passive income tax is RGD liable for in 2018? Assume the corporate tax rate is 21%. (Round your answer for excess net passive income to the nearest thousand).

Definitions:

Big-Name Stars

Highly famous or well-recognized celebrities, usually drawing significant public attention.

Skin Discolorations

Changes in the color of the skin that can result from a wide range of conditions, including infections, allergic reactions, and underlying diseases.

Sunshine

The natural light emitted by the sun, impacting various aspects of the earth's environment and climate.

Sales And Experience

The potential relationship and dynamics between a company's sales performance and the experience provided to its customers.

Q35: Clampett, Inc. has been an S corporation

Q41: _ are created by any affirmation of

Q42: Salespeople enjoy relatively good job security compared

Q56: Greg, a 40% partner in GSS Partnership,

Q58: Comet Company is owned equally by Pat

Q65: RGD Corporation was a C corporation from

Q75: Janet Mothra, a U.S. citizen, is employed

Q83: The probate estate consists of all property

Q92: Which of the following individuals is not

Q104: Clampett, Inc. has been an S corporation