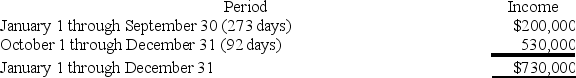

CB Corporation was formed as a calendar-year S corporation. Casey is a 60% shareholder and Bryant is a 40% shareholder. On September 30, 2018, Bryant sold his CB shares to Don. CB reported business income for 2018 as follows (assume that there are 365 days in the year):

How much 2018 income is allocated to each shareholder if CB uses its normal accounting rules to allocate income to the specific periods in which it was actually earned?

Definitions:

Good Faith Purchaser

A person who buys property without knowledge of any existing claims or defects in title, thus protected under the law.

Valuable Consideration

Any benefit, right, or interest that has tangible or intangible worth, which is provided by one party to another as part of a contract.

Reasonable Value

An estimated worth based on what is fair and sensible, considering the circumstances and context.

Necessaries

Items or services that are considered essential for maintaining a reasonable standard of living, such as food, clothing, and shelter.

Q20: A serial gift strategy consists of arranging

Q21: Orono Corporation manufactured inventory in the United

Q29: Wonder Corporation declared a common stock distribution

Q38: The state tax base is computed by

Q47: SoTired, Inc., a C corporation with a

Q51: The advantage of a salesperson using e-mail

Q52: Ashley owns a whole-life insurance policy worth

Q57: This year, Reggie's distributive share from Almonte

Q73: A general partner's share of ordinary business

Q76: Which of the following is a True