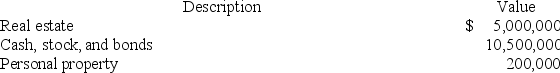

At his death in 2018, Nathan owned the following property:

The real estate is subject to a $1,700,000 mortgage and Nathan made taxable gifts in 2009 totaling $2 million at which time he offset the gift tax with an applicable credit (exemption equivalent of $2 million). Nathan has never been married. What is the amount of his estate tax due? (Use Exhibit 25-1)

Definitions:

Breakeven Point

The point where revenues just equal costs.

Just-In-Time

A manufacturing strategy that aligns raw-material orders with production schedules to minimize inventory costs.

Opportunity Situation

A scenario in which conditions are favorable for achieving a specific goal or for seizing a strategic advantage.

Inventory Turnover

A measure of how frequently a company's inventory is sold and replaced over a specific period.

Q21: The statement "I'm concerned that if we

Q25: Which of the following is the best

Q27: The estate and gift taxes share several

Q28: Which of the following statements is (are)

Q33: The three phases of the sales process

Q34: A(n)_ is resistance to a product in

Q37: Jane,a salesperson,has recently joined a company and

Q43: Which of the following forms of marketing

Q44: Knowledge needs represent the desire for personal

Q104: Clampett, Inc. has been an S corporation