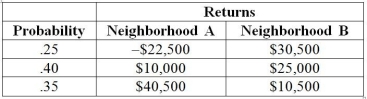

TABLE 5-7

There are two houses with almost identical characteristics available for investment in two different neighborhoods with drastically different demographic composition. The anticipated gain in value when the houses are sold in 10 years has the following probability distribution:

-Referring to Table 5-7, if your investment preference is to minimize the amount of risk that you have to take and do not care at all about the expected return, will you choose a portfolio that will consist of 10%, 30%, 50%, 70%, or 90% of your money on the house in neighborhood A and the remaining on the house in neighborhood B?

Definitions:

Current Assets

Assets that will be used or turned into cash within one year.

Current Ratio

A financial metric that measures a company's ability to pay its short-term obligations with its short-term assets, calculated by dividing current assets by current liabilities.

Debt-to-Equity

A measure of a company's financial leverage calculated by dividing its total liabilities by stockholders' equity, indicating the relative proportion of shareholder equity and debt used to finance the company's assets.

Total Asset Turnover

A financial ratio that measures a company's efficiency in using its assets to generate sales or revenue.

Q28: The diameters of 10 randomly selected bolts

Q51: The probability that a particular brand of

Q72: Referring to Table 3-12, what is the

Q100: A financial analyst is presented with information

Q111: In a game called Taxation and Evasion,

Q121: According to the Chebyshev rule, at least

Q129: Suppose that a judge's decisions follow a

Q160: Referring to Table 5-4, the probability of

Q189: Suppose Z has a standard normal distribution

Q201: Referring to Table 5-5, what is the