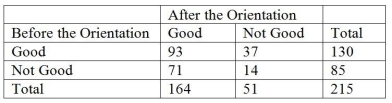

TABLE 12-15

The director of the MBA program of a state university wanted to know if a one week orientation would change the proportion among potential incoming students who would perceive the program as being good. Given below is the result from 215 students' view of the program before and after the orientation.

-Referring to Table 12-15, what should be the director's conclusion?

Definitions:

Economy

An area of the production, distribution, and trade of goods and services by different agents in a particular geographic region.

Ability-to-pay Taxation

A principle of taxation based on the belief that taxes should be levied according to an individual’s or entity’s capacity to pay, reflecting their income or wealth.

Progressive Tax Structure

A tax system in which the tax rate increases as the taxable amount increases, typically designed to distribute the tax burden more heavily on those with higher incomes.

High-income Receivers

Individuals or entities that receive a significantly higher amount of income compared to the median or average levels within a society or economic system.

Q10: Referring to Table 10-14, suppose α =

Q12: You have just computed a regression model

Q27: Referring to Table 13-11, which of the

Q80: Referring to Table 10-10, what is/are the

Q83: Referring to Table 13-13, what is the

Q99: Referring to Table 12-17, the calculated value

Q126: Referring to Table 10-12, construct a 95%

Q137: Referring to Table 13-3, the director of

Q165: Referring to Table 14-6, the estimated value

Q191: Referring to Table 12-5, there is sufficient