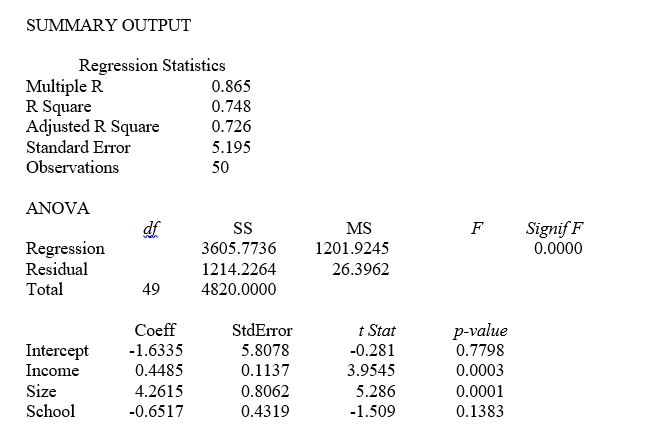

TABLE 14-4

A real estate builder wishes to determine how house size (House) is influenced by family income (Income) , family size (Size) , and education of the head of household (School) . House size is measured in hundreds of square feet, income is measured in thousands of dollars, and education is in years. The builder randomly selected 50 families and ran the multiple regression. Microsoft Excel output is provided below:

-Referring to Table 14-4, which of the following values for the level of significance is the smallest for which the regression model as a whole is significant?

Definitions:

Deferred Tax Asset

A tax benefit that refers to a reduction in a company's future tax liability due to deductible temporary differences and carryforwards.

FASB

The Financial Accounting Standards Board (FASB) is a private, non-profit organization standard-setting body whose primary purpose is to establish and improve Generally Accepted Accounting Principles (GAAP) within the United States in the public's interest.

Temporary Difference

A difference that arises between the tax bases of assets or liabilities and their carrying amount in the financial statements, which will result in taxable or deductible amounts in future years.

Q4: Referring to Table 14-17 Model 1, _

Q34: Referring to Table 15-6, what is the

Q46: Referring to Table 12-5, the expected cell

Q69: Referring to Table 12-18, what is your

Q80: A regression had the following results: SST

Q126: Referring to Table 13-4, the least squares

Q147: The residual represents the discrepancy between the

Q182: Referring to Table 12-2, the same decision

Q198: In a two-way ANOVA, it is appropriate

Q208: Referring to Table 13-3, the least squares