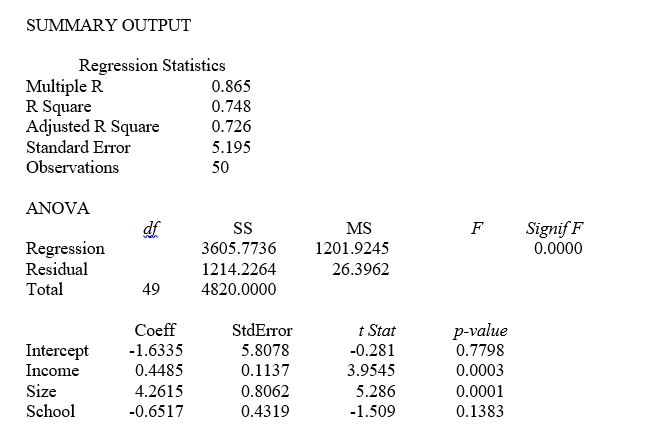

TABLE 14-4

A real estate builder wishes to determine how house size (House) is influenced by family income (Income) , family size (Size) , and education of the head of household (School) . House size is measured in hundreds of square feet, income is measured in thousands of dollars, and education is in years. The builder randomly selected 50 families and ran the multiple regression. Microsoft Excel output is provided below:

-Referring to Table 14-4, at the 0.01 level of significance, what conclusion should the builder reach regarding the inclusion of Income in the regression model?

Definitions:

Depreciable Assets

Long-term assets subject to depreciation, meaning their costs are systematically allocated over their useful lives as they are used and wear out.

Depreciation Methods

Various approaches for allocating the cost of an asset over its useful life, such as straight-line or declining balance methods.

Group Depreciation Method

An accounting technique used to depreciate a portfolio of assets collectively, often applied to assets with similar characteristics and useful lives.

Accumulated Depreciation

This represents the total amount of depreciation expense that has been recorded against a fixed asset since it was acquired.

Q50: The Cp statistic is used<br>A) to determine

Q55: Referring to Table 14-5, one company in

Q75: Referring to Table 15-2, given a quadratic

Q85: Referring to Table 15-3, suppose the chemist

Q141: Referring to Table 16-6, the forecast for

Q143: Referring to Table 13-11, there appears to

Q166: Referring to Table 13-3, the director of

Q294: Referring to Table 14-2, for these data,

Q309: Referring to Table 14-3, one economy in

Q336: Referring to Table 14-17 Model 1, there