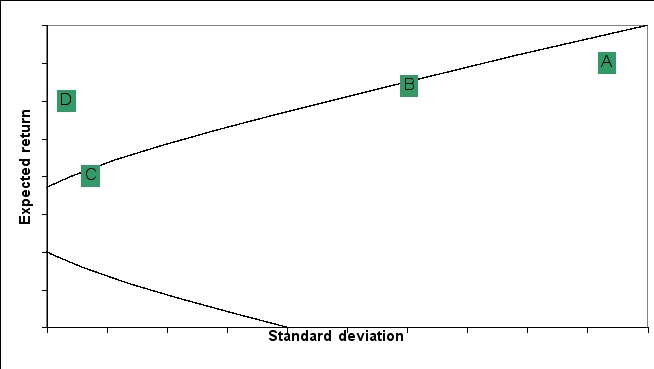

The standard deviation and expected returns for 4 portfolios (A, B, C, and D)are graphed on the following efficient frontier:

Which of the following portfolios (or combinations)are likely to be preferred by a risk-averse investor? Which of the following portfolios (or combinations)are likely to be preferred by a risk-loving investor? Explain your reasoning.

Definitions:

Mixed/Whole Numbers

Numbers consisting of both a whole number and a fractional part, usually written with the whole number and fraction separated by a space.

Rate

The ratio of change in one variable relative to another, often used in contexts of finance (interest rates), growth rates, or other measurements of change.

Decimal Places

The places for digits to the right of the decimal point, representing tenths, hundredths, thousandths, and so forth.

Base

In finance, it typically refers to the basic rate or the initial point of reference from which calculations are made or adjusted.

Q21: Suppose you own a two-security portfolio.You have

Q30: Aquarius Inc.has posted the following annual returns

Q32: Suppose you have an opportunity to invest

Q32: Johan, a corporate manager, often takes significant

Q37: Debt ratings assigned by professional debt-rating services

Q42: Explain how derivatives led to the worst

Q48: Jay writes a call option with a

Q59: Franklin needs to have $1,000 in 8

Q66: What is the main purpose behind share

Q116: What is the approximate IRR of a