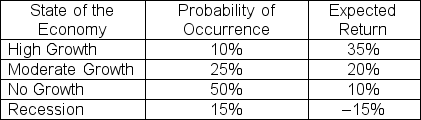

Given the information in the following table, what is the expected return of the security?

Definitions:

Tax Rate

The rate at which the government imposes taxes on the income or earnings of a person or a company.

Deferred Tax Asset

Represents future tax relief for a company, arising from deductible temporary differences, carryforward losses, or credits.

Accrued Product Warranty Costs

Costs that have been incurred but not yet paid for product warranties, recognized as liabilities on the balance sheet.

Enacted Tax Rates

The legally approved rates of taxation set by governmental authorities.

Q8: It is now October 25.Jenny has just

Q28: Which of the following bonds is secured

Q36: Suppose Montreal Import Company has to pay

Q42: Explain how derivatives led to the worst

Q46: Which of the following statements is TRUE?<br>A)The

Q76: Cinderella plans to form a portfolio with

Q76: Manic Corporation issued 200,000 preferred shares with

Q80: Given the following forecasts, what is the

Q84: Junkies Corporation has just paid a dividend

Q111: Which portfolio represents the minimum variance portfolio?<br>A)B<br>B)C<br>C)A<br>D)D