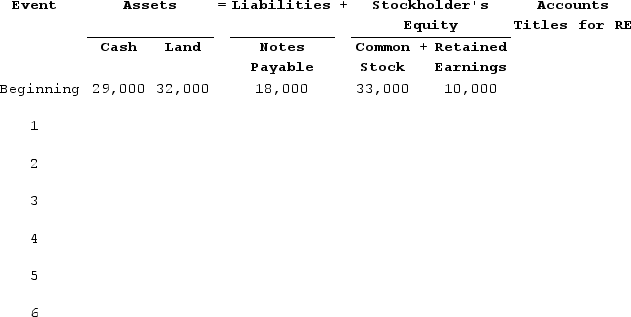

At the beginning of Year 2, the accounting records of Grace Company included the accounts and balances shown on the first row of the table below. During Year 2, the following transactions occurred:Received $95,000 cash for providing services to customersPaid salaries expense, $50,000Purchased land for $12,000 cashPaid $4,000 on note payablePaid operating expenses, $22,000Paid cash dividend, $2,500Required:a)Record the transactions in the appropriate accounts. Record the amounts of revenue, expense, and dividends in the retained earnings column. Enter 0 for items not affected. Provide appropriate titles for these accounts in the last column of the table. (The effects of the first event are shown below.)

b)What is the amount of total assets as of December 31, Year 2?c)What is the amount of total stockholders' equity as of December 31, Year 2?

b)What is the amount of total assets as of December 31, Year 2?c)What is the amount of total stockholders' equity as of December 31, Year 2?

Definitions:

Q17: At the beginning of Year 2, the

Q34: Which of the following account titles is

Q53: Indicate whether each of the following statements

Q81: A trial balance can be in balance,

Q101: Indicate whether each of the following statements

Q112: If cash from operating activities was $48,000,

Q130: Wichita, Incorporated reported the following amounts on

Q133: What is the purpose of the accrual

Q145: Indicate whether each of the following statements

Q172: Who are the three distinct types of