Use the following to answer questions:

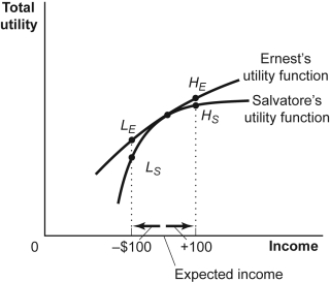

Figure: Differences in Risk Aversion

-(Figure: Differences in Risk Aversion) Look at the figure Differences in Risk Aversion. Which of the following statements is CORRECT?

Definitions:

Quarterly Estimated Payments

Payments made to the IRS by self-employed individuals or entities that anticipate owing tax of $1,000 or more, paid in four equal installments throughout the year.

Estimated Payment

refers to tax payments made in advance throughout the year, based on an estimate of the taxpayer's annual income.

Corporate AMT Exemption

An exemption that prevents corporations from having to pay the Alternative Minimum Tax up to a certain threshold of income.

AMT

Alternative Minimum Tax, a separate tax system in the United States designed to ensure that certain taxpayers pay at least a minimum amount of tax.

Q27: (Figure: Comparative Advantage) Look at the figure

Q42: (Table: Income and Utility for Tyler) The

Q65: If the United States increases tariffs on

Q135: (Figure: Shifts in Demand and Supply II)

Q148: Well-functioning markets allow:<br>A) mutually beneficial trades to

Q152: (Figure: Shifts in Demand and Supply II)

Q155: Well-defined property rights:<br>A) can allow for mutually

Q187: Which of the following offices of the

Q273: The _ tomatoes will decrease if fertilizer

Q314: (Scenario: Countries A and B) Look at