Using the Spreadsheet Below to Answer the Following Question(s) -Using the Spreadsheet Below, Provide the Steps in Using Excel

Using the spreadsheet below to answer the following question(s).

The spreadsheet below shows the net income model for a company that sells shoes.

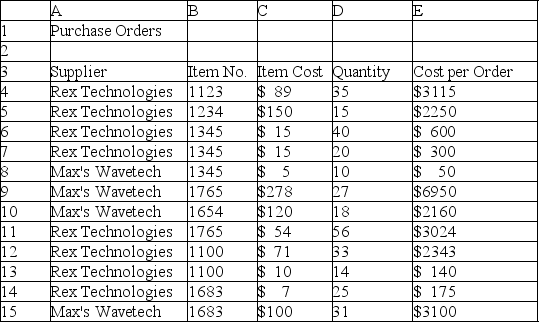

-Using the spreadsheet below, provide the steps in using Excel formulas in finding the cost of the first order for Item number 1345, and the total cost of all Item numbers 1345, using the Match and Index functions in Excel.Column B is sorted by item number in ascending order.

Definitions:

Contextual Aggression

Aggressive behavior that is influenced by the immediate environment or situation, rather than stemming from internal characteristics.

Disordered Aggression

Abnormal, often uncontrollable, aggressive behavior that can be a symptom of psychological disorders.

Values

The qualities people see as most desirable and important, affecting people’s thinking and behavior.

Desirable

A quality or feature that makes something wanted, wished for, or attractive.

Q1: What is the best advice Joelle can

Q7: The procedure used to obtain names of

Q20: Satisfactions can come from:<br>A)research studies done on

Q33: The _ is a formal statistical measure

Q34: Which decision model incorporates the process of

Q36: The generic product is the basic,substantive product

Q63: One of Joelle's challenges when coaching salespeople

Q72: Your ability to separate yourself and your

Q73: A major barrier to prospecting is time.

Q75: How is this handbag being positioned and