Use the table below to answer the following question(s) .

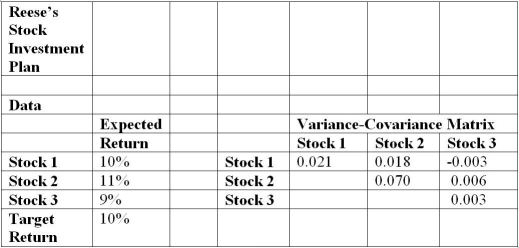

Jonathan Reese is considering three stocks in which to invest with a fixed budget.The table below provides information on Jonathan's expected returns for each stock.The table also provides information, collected from market researchers, on the variance-covariance matrix of the individual stocks.He expects a total return of at least 10%.

Develop a quadratic optimization model to find the optimal allocation of the budget to each stock, and variance calculations for squared terms and cross-products based on the variance-covariance matrix.

-According to the model, what is the squared term value for Stock 3 variance?

Definitions:

Sherman Act

A landmark federal statute in the field of United States antitrust law passed in 1890 that prohibits certain business activities that reduce competition in the marketplace.

Clayton Act

A U.S. antitrust law aimed at increasing competition by preventing unfair trade practices and monopolies.

Federal Trade Commission Act

A U.S. federal law established in 1914 to prevent unfair or deceptive business practices, including anti-trust laws, to promote fair competition.

Social Regulation

Rules and standards imposed by governments to protect public welfare, including health, safety, and the environment.

Q13: Supercoiling is important for DNA structure, because<br>A)

Q20: What is the value of slack obtained

Q22: Which option in Risk Solver Platform allows

Q33: Which of the following formulas is used

Q34: According to the model, what is the

Q35: An infeasible problem is one for which

Q40: Which of the following is formed on

Q48: Which statement is TRUE regarding protein synthesis?<br>A)

Q50: Latin Hypercube sampling differs from Monte Carlo

Q55: Calculate the employer contribution in Sheila's fourth