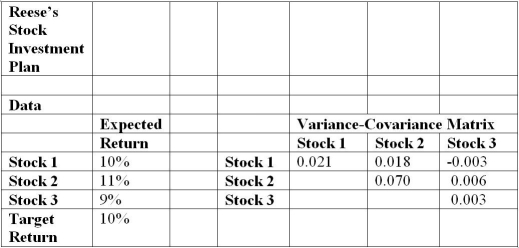

Jonathan Reese is considering three stocks in which to invest with a fixed budget.The table below provides information on Jonathan's expected returns for each stock.The table also provides information, collected from market researchers, on the variance-covariance matrix of the individual stocks.He expects a total return of at least 10%.

Using the table above, provide the objective function for minimal variance, and the constraints for creating an optimization model.

Definitions:

Financial Asset

An asset that derives value because of a contractual claim, such as cash, stocks, bonds, and bank deposits.

Financial Liability

An obligation to deliver cash or another financial asset to another entity, or to exchange financial instruments under potentially unfavorable conditions.

Offset Conditions

Conditions that allow entities to negate or counterbalance one position with another, commonly used in accounting and finance to manage risk or net-off liabilities against assets.

Different Financial Instruments

Various types of investment assets, including stocks, bonds, derivatives, and mutual funds, that provide a way for individuals and businesses to invest, finance operations, or manage risk.

Q3: What will be the total profit contribution

Q3: What is the increase in total cost?<br>A)$

Q18: You are trying to design a protein

Q19: Due to decreasing profits, if the production

Q29: Which is/are a function(s) of the cytoplasmic

Q30: When counting colonies on an agar plate<br>A)

Q33: Draw conclusions for test of hypothesis for

Q40: With respect to B12, what is the

Q48: What is the value of the mean

Q76: Using phase contrast microscopy on a wet