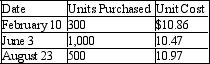

One of the methods permitted by Generally Accepted Accounting Principles for reporting the value of a firm's inventory is weighted-average inventory pricing. The Boswell Corporation began its fiscal year with an inventory of 156 units valued at $10.55 per unit. During the year it made the purchases listed in the following table.

At the end of the year, 239 units remained in inventory. Determine: a) The weighted-average cost of the units purchased during the year. b) The weighted-average cost of the beginning inventory and all units purchased during the year. c) The value of the ending inventory based on the weighted-average cost calculated in b.

Definitions:

Overstated Costs

The reporting or recording of expenses that are higher than the actual or true costs incurred.

Inventory Costs

Inventory Costs encompass all expenses related to holding and managing inventory, including purchasing, storing, and handling costs.

Specific Identification

Specific identification is an inventory valuation method that tracks the cost of individual items for the purpose of determining cost of goods sold and ending inventory.

Accepted Methods

Refers to officially recognized or sanctioned techniques or procedures used in a particular field or discipline.

Q172: Last year, Canada's exports to the U.S.

Q207: Ivory hand-soap is advertised as being

Q226: An effective sales plan objective should be<br>A)

Q245: At Xerox there is a passion for

Q251: A salesperson at Toshiba America Medical Systems

Q255: A waitress at a TGI Friday's restaurant

Q267: Evaluate to six-figure accuracy:<br> <span class="ql-formula"

Q296: 350% of what amount is $1,000 accurate

Q301: List the four things that research suggests

Q305: Solve the following set of equations graphically:<br>4x