Given the Following Information on Three Stocks = -05333

Bc

Now Suppose You Diversify into Two Securities

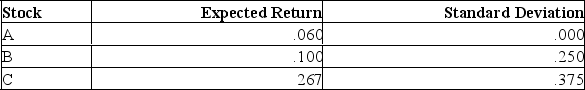

Given the following information on three stocks:

= -.05333

= -.05333

bc

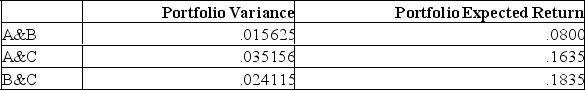

Now suppose you diversify into two securities. Given all choices, can any portfolio be eliminated? Assume equal weights.

Definitions:

Preexisting Duty Rule

A legal principle that an existing obligation or duty cannot serve as consideration for a new contract.

Rescission

The act of canceling a contract, returning both parties to their pre-contractual situation.

Mutually Agree

A situation in which two or more parties come to a common understanding or consent on a matter.

Executed

indicates that an operation or task has been successfully carried out or implemented to its full extent.

Q2: Last month you introduced a new product

Q13: As the degree of sensitivity of a

Q23: You have observed an apparent, yet odd,

Q32: Technically speaking, a long-term corporate debt offering

Q42: The Equivalent Annual Cost method allows comparison

Q43: Which of the following values is closest

Q44: XYZ INC has several divisions and the

Q46: A mutually exclusive project is a project

Q48: Standard deviation measures _ risk.<br>A) total<br>B) nondiversifiable<br>C)

Q69: A number of publicly traded firms pay