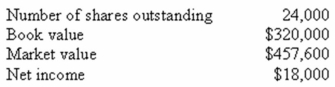

Birds and More is considering a project which requires the purchase of $175,000 of fixed assets.The net present value of the project is $4,500.Equity shares will be issued as the sole means of financing this project.The price-earnings ratio of the project equals that of the existing firm.What will the new market value per share be after the project is implemented given the following current information on the firm?

Definitions:

Flexible Manufacturing Overhead Budget

A plan that estimates the variable and fixed overhead costs for each level of production activity.

Direct Labor Hour

A measure of the labor directly involved in producing goods or services, expressed in hours.

Volume Overhead Variances

The difference between the budgeted overhead costs based on expected volume and the actual overhead costs incurred.

Controllable Variance

The difference between actual and budgeted performance that can be directly managed or controlled by responsible managers.

Q5: Which of the following will increase the

Q35: Your current sales consist of 45 units

Q41: The Dog House expects sales of $560,

Q55: Existing shareholders:<br>A)may or may not have a

Q57: The BAT model is used to:<br>A)maximize the

Q59: The expected return on a stock given

Q82: Flotation costs for a levered firm should:<br>A)be

Q87: Jefferson Refining is issuing a rights offering

Q89: Morris Industries has a capital structure of

Q96: If a firm uses its WACC as